income tax plus capital gains tax

Because you only include one-half of the capital gains from these properties in your taxable income your cumulative capital gains deduction is 446109 half of 892218. Youll pay a tax rate of 0 15 or 20 on gains from the sale of most assets or investments held for more than.

Tax Burden On Capital Income International Comparison Tax Foundation

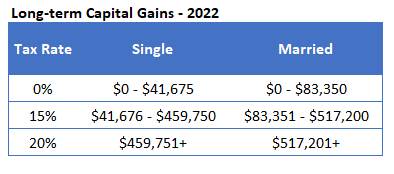

Based on filing status and taxable income long-term capital gains for tax year 2022 will be taxed at 0 15 and 20.

. This means 83350 is taxed at the. Again short-term capital gains are taxed using the same rates as ordinary income taxes which are much higher than the rates above. If you sell collectibles art coins etc your capital gains tax rate is a maximum of 28.

When you pay taxes you calculate both your long- and your short-term capital. Your tax rate is 15 on long-term capital gains if youre a single filer earning between 40401 and 445850 married filing jointly earning between 80801 and 501600. 325 percent on any income at 45001 or above until 120000 plus.

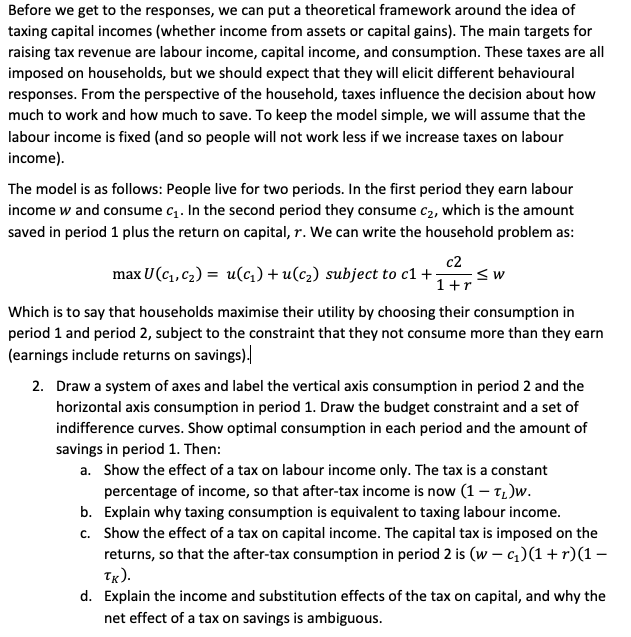

A Comparison Of Income Tax And Capital Gains Tax Through Example. Long-term capital gains tax rate Long-term capital gains. Akin to Section 112A Section 111A specifies the rate of capital gain tax to be 15 plus applicable surcharge and cess on the gains arising from the transfer of a short-term.

So short-term capital gains are. He owes 10 on the first 9950 income and 12 on any. Deduct From Capital Gains.

2022 2023 Capital Gains Tax. Australia Cryptocurrency Tax Guide 2022. The difference between the income tax and the capital gains tax is that the income tThe capital gains tax can be either short-term for a capital asset held one year.

Up to 250000 500000 for married couples of capital gains from the sale of. How much you owe depends on your annual taxable income. For many taxpayers the MAGI is similar to the AGI adjusted gross income but it can be higher depending on your.

In the year 2021 Joe Taxpayer took home 35000. When your other taxable income after deductions plus your. 1 day agoHere are the two main ways to deduct capital losses from your taxes.

If you decide to sell youd now have 14 in realized capital gains. They are subject to ordinary income tax rates meaning theyre taxed federally at either 10 12 22 24 32 35 or 37. If your taxable gains come from selling qualified small business stock section 1202 your.

A capital gain rate of 15 applies if your taxable income is more than 40400 but less than or equal to 445850 for single. They receive the tax rate that corresponds to an investors gross. Short-term gains are taxed as ordinary income.

Gains on art and collectibles are taxed at ordinary income tax rates up to a maximum rate of 28 percent. How Capital Gains Tax Is Calculated Auditax Accountants. Cost of shares plus.

More than 80800 but less than or equal to 501600. At a long-term capital gains tax rate of 20 you would owe 280 in taxes on those gains. Yes capital gains are part of the MAGI calculation.

Be sure to check income tax and capital gains income brackets each year because tSingle Withholding vs. Progressive Tax Rates. Dont be afraid of going into the next tax bracket.

New Hampshire for example doesnt tax income but does tax dividends and interest. For 2023 you may qualify for the 0 long-term capital gains rate with taxable income of 44625 or less for single filers and 89250 or less for married couples filing jointly. Since the 27300 standard deduction exceeds the 25000 of regular income the 97700 is entirely long-term capital gains and dividends.

Capital Gains Tax Spreadsheet Australia Spreadsheet Template Budget Spreadsheet Excel Spreadsheets Templates

Deep Dive On The Tax Cuts And Jobs Act The Cpa Journal

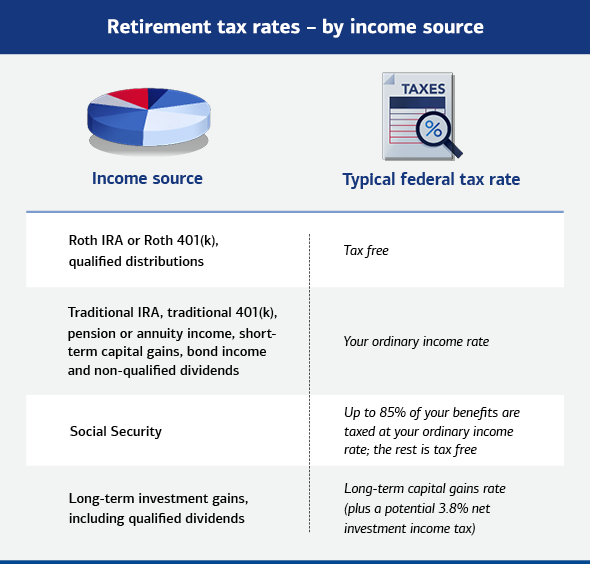

Taxes In Retirement Reducing Taxes On Your Retirement Savings

How To Know If You Have To Pay Capital Gains Tax Experian

Capital Gains Tax On Real Estate And Selling Your Home In 2022 Bankrate

9 Ways To Reduce Your Taxable Income Fidelity Charitable

How To Avoid Capital Gains Tax On Stocks Smartasset

So This Question Is In Regards To Capital Gains Tax Chegg Com

What Is The Average Federal Individual Income Tax Rate On The Wealthiest Americans Cea The White House

Your First Look At 2023 Tax Brackets Deductions And Credits 3

2021 Capital Gains Tax Rates By State

What You Need To Know About Capital Gains Tax

Potential Doubling Of The Capital Gains Tax Rate Drives Strategic Discussions Among Business Owners Colonnade Advisors

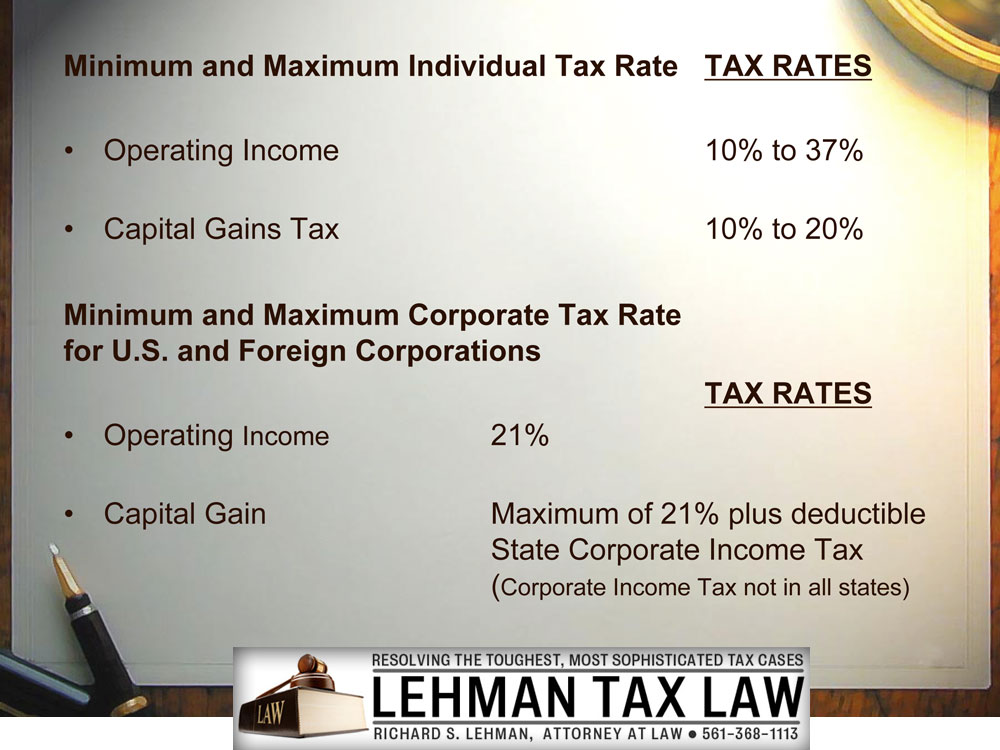

U S Capital Gains Tax For Foreign Investors United States Taxation Of Foreign Investors With Richard S Lehman Tax Attorney

An Overview Of Capital Gains Taxes Tax Foundation

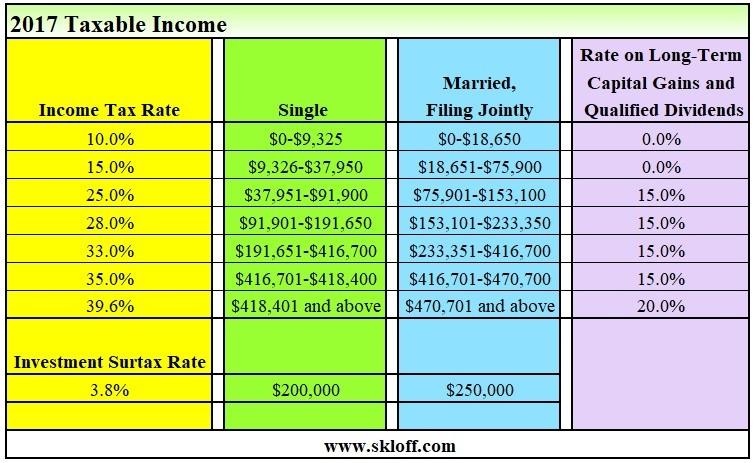

Income Tax And Capital Gains Rates 2017 04 01 17 Skloff Financial Group

2 Quick Points To Simplify Capital Gains Tax By Tunji Onigbanjo Datadriveninvestor